This is one of the most important elements to understand if you are to become a successful Trader

Having the correct Risk Management in place is essential to having longevity in this game.

Over risking and over leveraging your trading account is a common theme in this business resulting in over 90% of new Traders blowing their trading account.

Learning how to manage risk and understanding how less is more will statistically help to improve overall performance and in turn, overall results.

Amount Lot Size 2x Open Position (100 pip Stop Loss)

Less than £1k 0.01=10 pence per pip (pp) 2 x 0.01 = 0.02/20p Total for T1 & T2

£1k 0.01 = 10 pence per pip 2 x 0.01 = 0.02/20pp Total = £20 Risk

£2k 0.02 = 20 pence per pip 2 x 0.02 = 0.04/40pp Total = £40 Risk

£3k 0.03 = 30 pence per pip 2 x 0.03 = 0.06/60pp Total = £60 Risk

£4k 0.04 = 40 pence per pip 2 x 0.04 = 0.08/80pp Total = £80 Risk

£5k 0.05 = 10 pence per pip 2 x 0.01 = 0.02/20pp Total = £20 Risk

£10k 0.1 = £1 pp 2 x 0.1 = £2 Total = £200 Maximum Risk

£20k 0.2 = £2 pp 2 x 0.1 = £2 Total = £400 Maximum Risk

£50k 0.5 = £5 pp 2 x 0.5 = £10 Total = £1k Maximum Risk

£100k 1.0 = £10 pp 2 x 1.0 = £20 Total = £2k Maximum Risk

We Risk 2% Total of Our Capital =1% per position

This is based on using up to a 100 pip Stop Loss.

Example :- £10k Account.

Trade £1 per pip x2 open positions with maximum 100 pips Stop Loss.

This means you will have £2 per pip in total open a trade and can have up to a 100 pip Stop Loss and your total loss will not exceed 2% or £200.

Note, most of our trades have a Stop Loss smaller than 100 pips.

- This means we will often be risking less than 2% of our account on a Trade.

- This also allows us the option of opening additional positions or trading higher per pip based on the Stop Loss below.

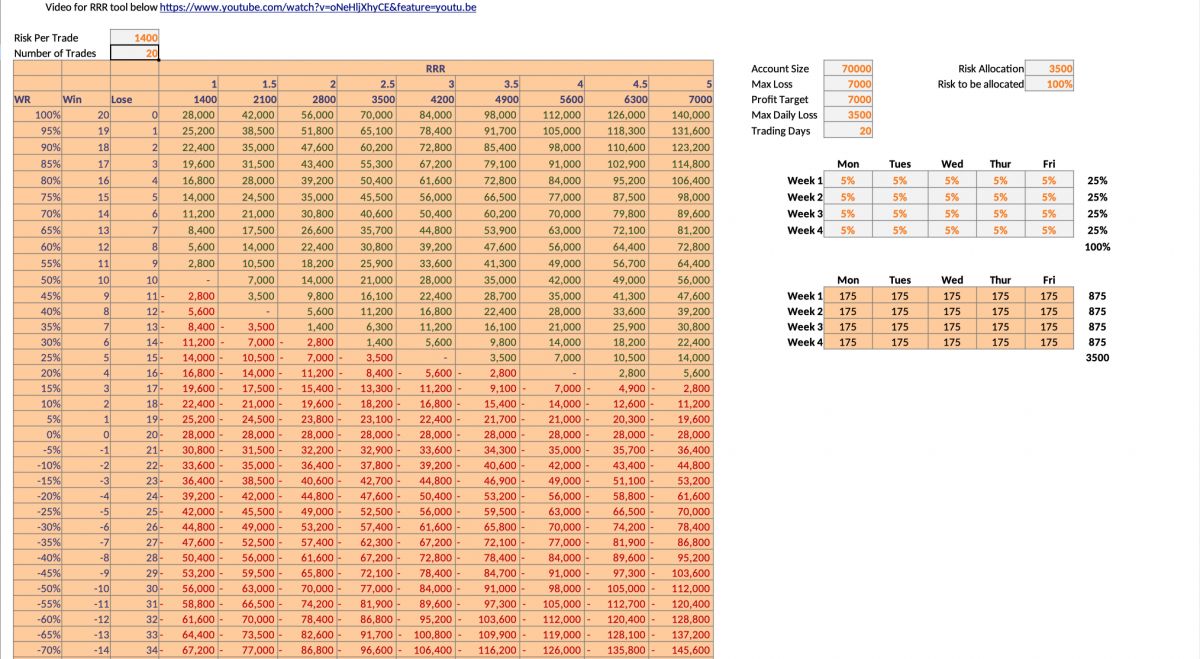

Our Risk to Reward Ratio (R: R) is 1:2, 1:3, 1:4 or 1:5

Meaning we aim to make 2 to 5 times what w risk on a trade

STOP LOSS MANAGEMENT GUIDE (based on 2% risk)

A £10k Account = £200 Total Risk (per trade) split into 2 positions

£10 per pip TOTAL RISK using a 20 pip Stop Loss Bank/Close Half @ T1

£8 per pip total risk using a 25 pip Stop Loss Bank/Close Half @ T1

£5 per pip total risk using a 40 pip Stop Loss Bank/Close Half @ T1

£4 per pip total risk using a 50 pip Stop Loss Bank/Close Half @ T1

£2 per pip total risk using a 100 pip Stop Loss Bank/Close Half @ T1

A £5k Account = £100 Total Risk (per trade) split into 2 positions

£5pp (2x£2.50) total risk 20 pip Stop Loss Bank/Close Half @ T1

£4pp (2x£2) total risk 25 pip Stop Loss Bank/Close Half @ T1

£2.50pp (2x£1.25) total risk 40 pip Stop Loss Bank/Close Half @ T1

£1pp (2x50p) total risk 100 pip Stop Loss Bank/Close Half @ T1

A £1k Account = £20 Total Risk (per trade) split into 2 positions

£1 (2x50p) total risk using a 20 pip Stop Loss Bank/Close Half @ T1

80p (2x40p) total risk using a 25 pip Stop Loss Bank/Close Half @ T1

40p (2x20p) total risk using a 50 pip Stop Loss Bank/Close Half @ T1

20p (2x10p) total risk using a 100 pip Stop Loss Bank/Close Half @ T1

ANY ACCOUNT SIZE LESS THAN £1K

Use 0.02 20p total risk (2x10p) Bank/Close Half @ T1

Example 1 = £10k Account opening 2 positions

100 pips = £2.00 per pip (2 x £1.00 Trades)

90 pips = £2.20 per pip (2 x £1.10 Trades)

80 pips = £2.50 per pip (2 x £1.25 Trades)

70 pips = £2.85 per pip (2 x £1.40 Trades)

60 pips = £3.30 per pip (2 x £1.65 Trades)

50 pips = £4.00 per pip (2 x £2.00 Trades)

40 pips = £5.00 per pip (2 x £2.50 Trades)

30 pips = £6.60 per pip (2 x £3.30 Trades)

20 pips = £10.00 per pip (2 x £5.00 Trades)

Example 2 = £5k Account opening 2 positions

100 pips = £1.00 per pip (2 x £0.50p Trades)

90 pips = £1.10 per pip (2 x £0.55p Trades)

80 pips = £1.20 per pip (2 x £0.60p Trades)

70 pips = £1.40 per pip (2 x £0.70p Trades)

60 pips = £1.60 per pip (2 x £0.80p Trades)

50 pips = £2.00 per pip (2 x £1.00 Trades)

40 pips = £2.50 per pip (2 x £1.25 Trades)

30 pips = £3.30 per pip (2 x £1.15 Trades)

20 pips = £5.00 per pip (2 x £2.50 Trades)